Reverse Head And Shoulders Pattern (Updated 2023)

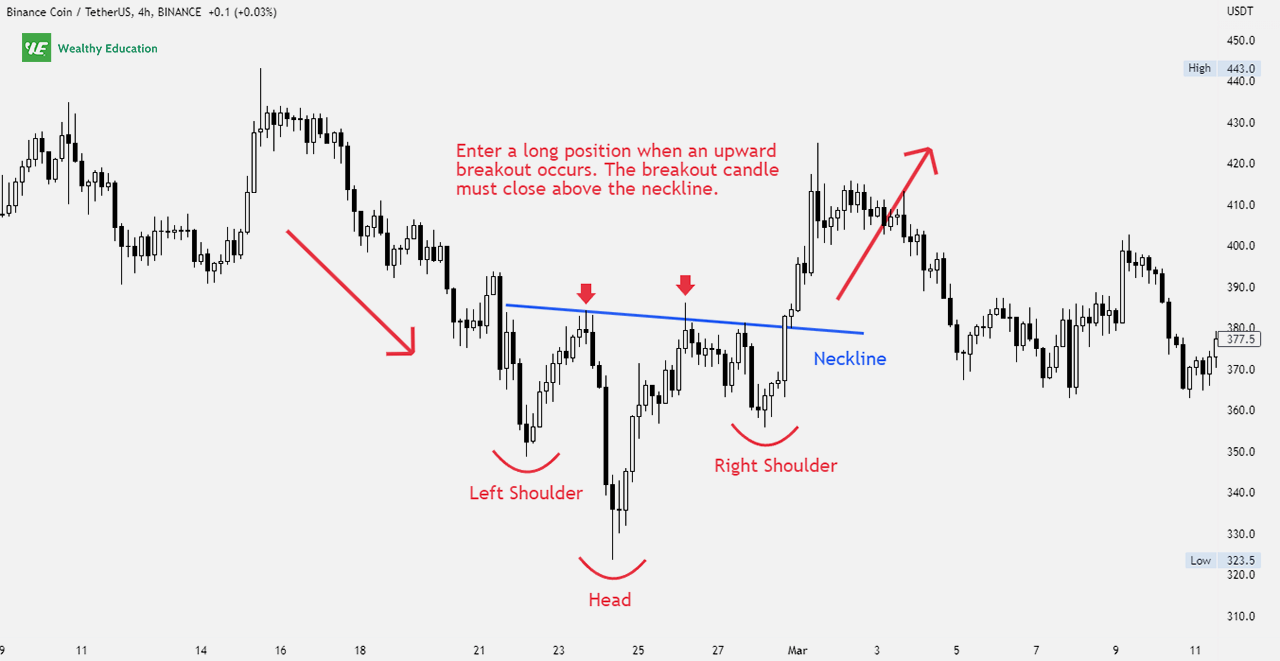

How To Identify The Inverse Head And Shoulders Pattern? Price action forms the shape of an upside down head atop two upside down shoulders, with three total troughs. The left shoulder and first trough is formed on high volume. Volume begins to decline with a higher trough forming a head. Finally, a right shoulder of roughly equal depth as the.

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

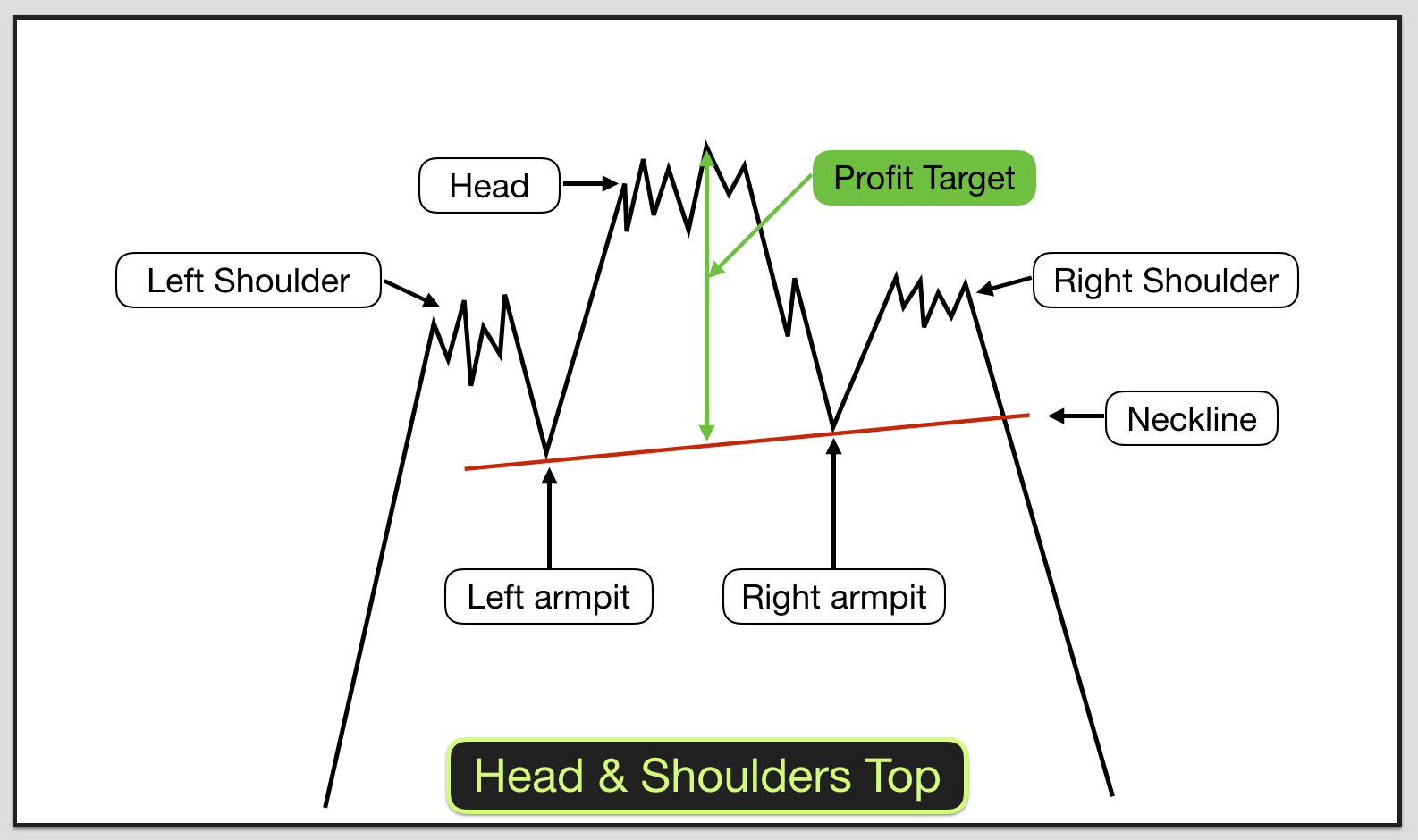

This classic reversal pattern is a high probability chart formation that predicts a bullish to bearish trend reversal with a big accuracy. The same formation can appear upside down, which we call as an inverse Head and Shoulders. In this last case, the pattern predicts a possible trend change from down to up. Let's look at them more closely.

Inverse Head and Shoulders Pattern Trading Strategy Guide

A head and shoulders pattern has four components: After long bullish trends, the price rises to a peak and subsequently declines to form a trough. The price rises again to form a second high.

invertedheadandshoulderspattern Forex Training Group

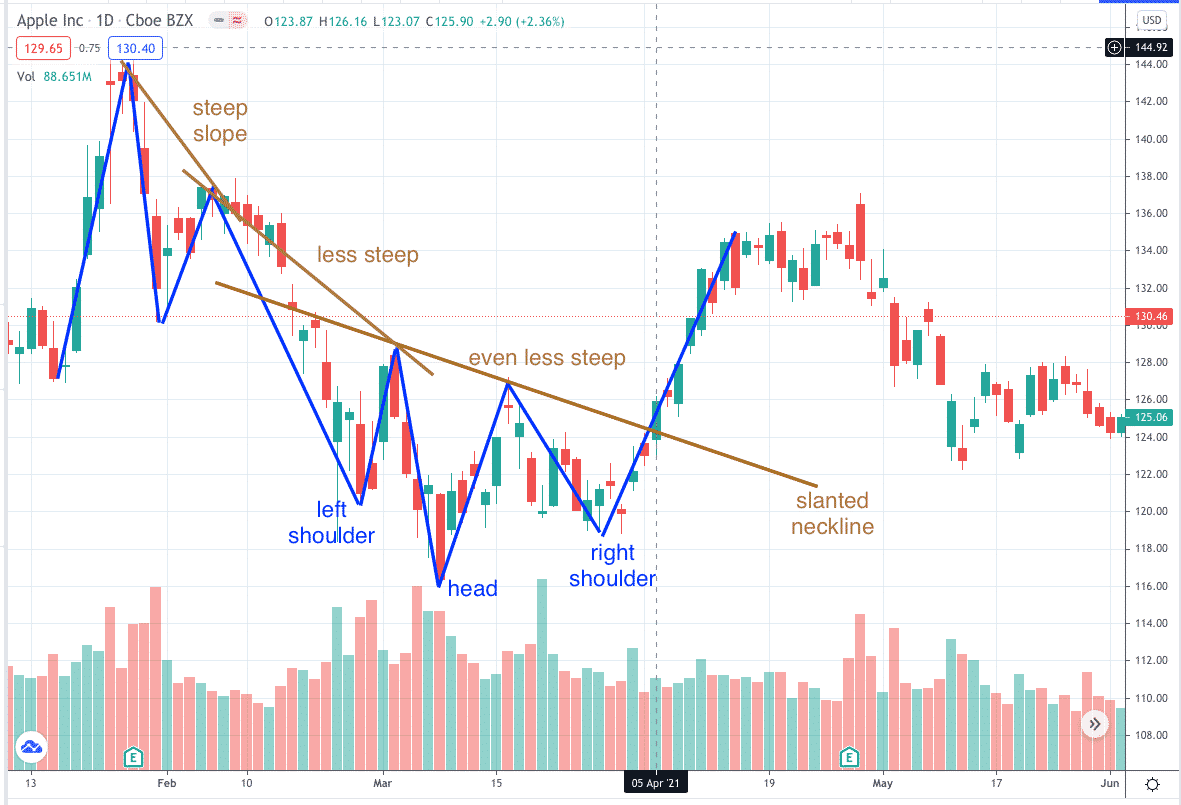

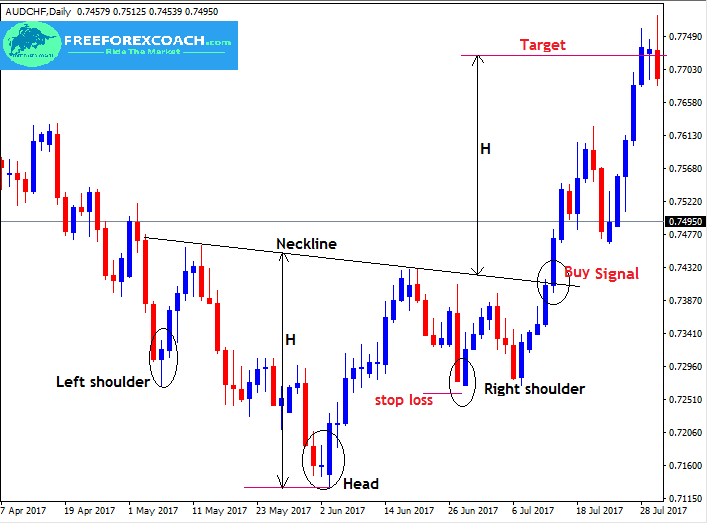

The profit target for the inverse head and shoulders pattern would be: $113.20 (this is the high after the left shoulder) - $101.13 (this is the low of the head) = $12.07. This difference is.

Head and Shoulders Pattern Trading Strategy Synapse Trading

FREE SHARES! Find out how to get FREE SHARES in Aalavon Investments by visiting us at: www.aalavon.comLearn to Day Trade for Free! Watch more free educationa.

Forex Head And Shoulders Pattern Xfx Trading Reviews

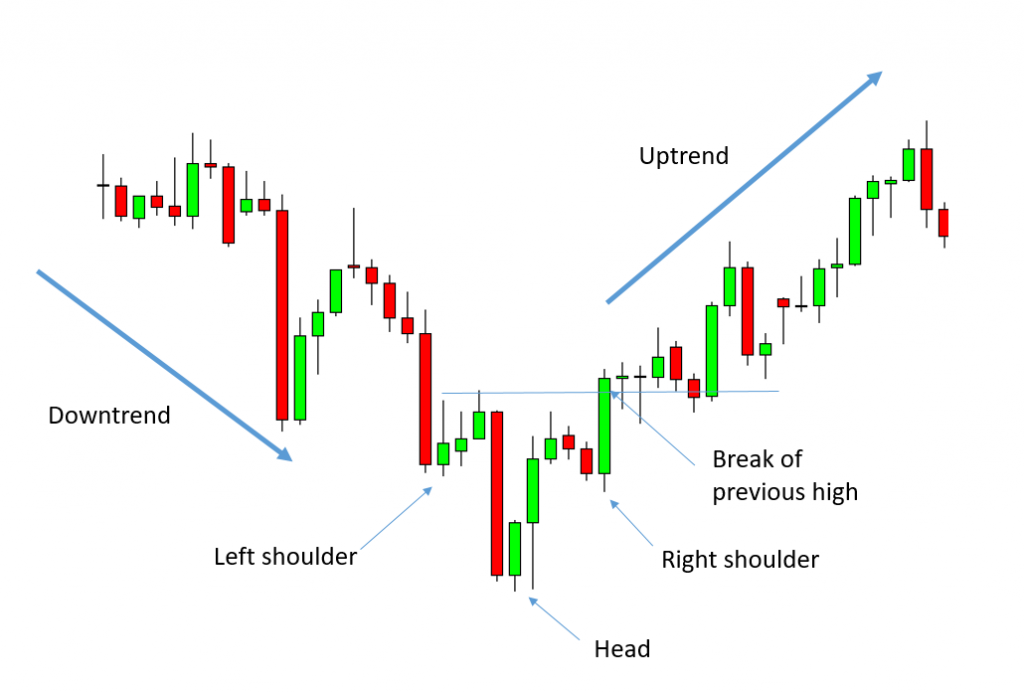

It is basically a head and shoulders formation, except this time it's upside down . 🙃 A valley is formed (shoulder), followed by an even lower valley (head), and then another higher valley (shoulder). These formations occur after extended downward movements.

Inverse Head and Shoulders Pattern How To Spot It

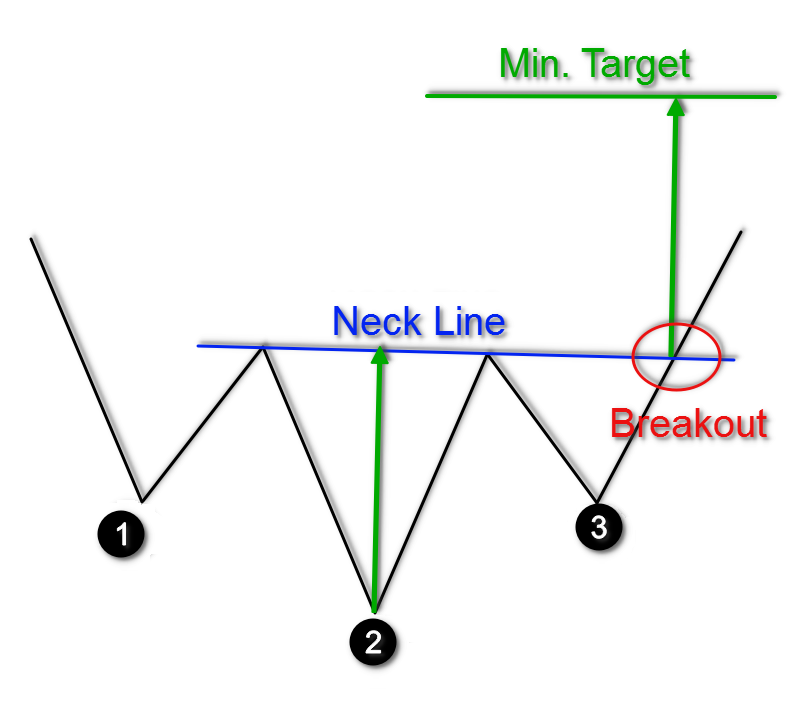

The inverse head-and-shoulders pattern is a common downward trend reversal indicator. You can enter a long position when the price moves above the neck, and set a stop-loss at the low point of the right shoulder. The height of the pattern plus the breakout price should be your target price using this indicator.

Inverse Head and Shoulders in Forex Identify & Trade Free Forex Coach

Head and Shoulders Pattern vs. Inverted Head and Shoulders. The inverted head and shoulders pattern forms after a downtrend and signals a potential trend reversal to the upside. It contains the same elements as a standard chart head and shoulders but in an upside down formation. Key differences: Standard head and shoulders is bearish, inverted.

Upside down head and shoulders for FXUSDJPY by philstodd84 — TradingView

The formation is upside down and the volume pattern is different from a head and shoulder top. Prices move up from first low with increase volume up to a level to complete the left shoulder formation and then fall down to a new low. A recovery move follows that is marked by somewhat more volume than seen before to complete the head formation.

Head and Shoulders pattern How To Verify And Trade Efficiently How

The inverse head and shoulders, or inverted H&S pattern, is formed at the end of a downtrend. Is the inverse head and shoulders bullish or bearish? It's a bullish pattern that predicts a reversal from a down to an uptrend. It's the opposite of the head and shoulders setup, which appears at the end of an uptrend and signals a coming price decline.

Head And Shoulders Pattern All you need to know Living From Trading

The head is the largest of the three peaks. An Inverse Head and Shoulders pattern is when the head and shoulders pattern is upside down and follows similar structure in reverse (see "Turning H&S on its head" below). The Inversion Head and Shoulders is a reversal pattern from an established downtrend. Inverse H&S pattern components

upside down head and shoulder for FXUSDCAD by MattGauvin — TradingView

The inverse head and shoulders pattern is an indicator. It shows a reversal of a downward trend in price. It is one of the most common trend reversal indications. As the price goes downward, it reaches a low point (a trough) and then starts to recover and move upward. Market resistance then drags it back down into another trough.

Trading the Inverse Head and Shoulders Pattern Warrior Trading

What Is a Reverse Head and Shoulders Pattern? A reverse head and shoulders chart pattern is a short-term bullish reversal pattern that occurs near a market bottom. It consists of 3 consecutive troughs with the middle trough lower than the other two, which form a head and two shoulders on a price chart.

How To Trade Inverse Head And Shoulders Chart Patterns YouTube

The inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. It is the opposite of the head and shoulders chart pattern, which is.

Inverse Head and Shoulders Pattern [2022 Update] Daily Price Action

The inverse head and shoulders, or inverse H&S for short, is essentially an upside down head and shoulders pattern. Like the bearish head and shoulders pattern it is named after, the inverse head and shoulders pattern is a powerful bullish trend reversal pattern.

How To Trade Blog What is Inverse Head and Shoulders Pattern

Combination of valleys where the central one is lower than the left and the right troughs shapes the Inverse Head and Shoulders pattern. Its a reversal pattern. Upside move should appear. Watch Neckline to be broken for confirmation. Target is equal to the depth of Head added to the Neckline breakout point. 4.